-

0800 326 5559

- International: 0330 333 8188

0800 326 5559

0800 326 5559

We believe everyone has the chance to turn their situation around with substance misuse, no matter how complicated their current situation may be. OK Rehab helps by offering an advisory and referral service for people seeking treatment.

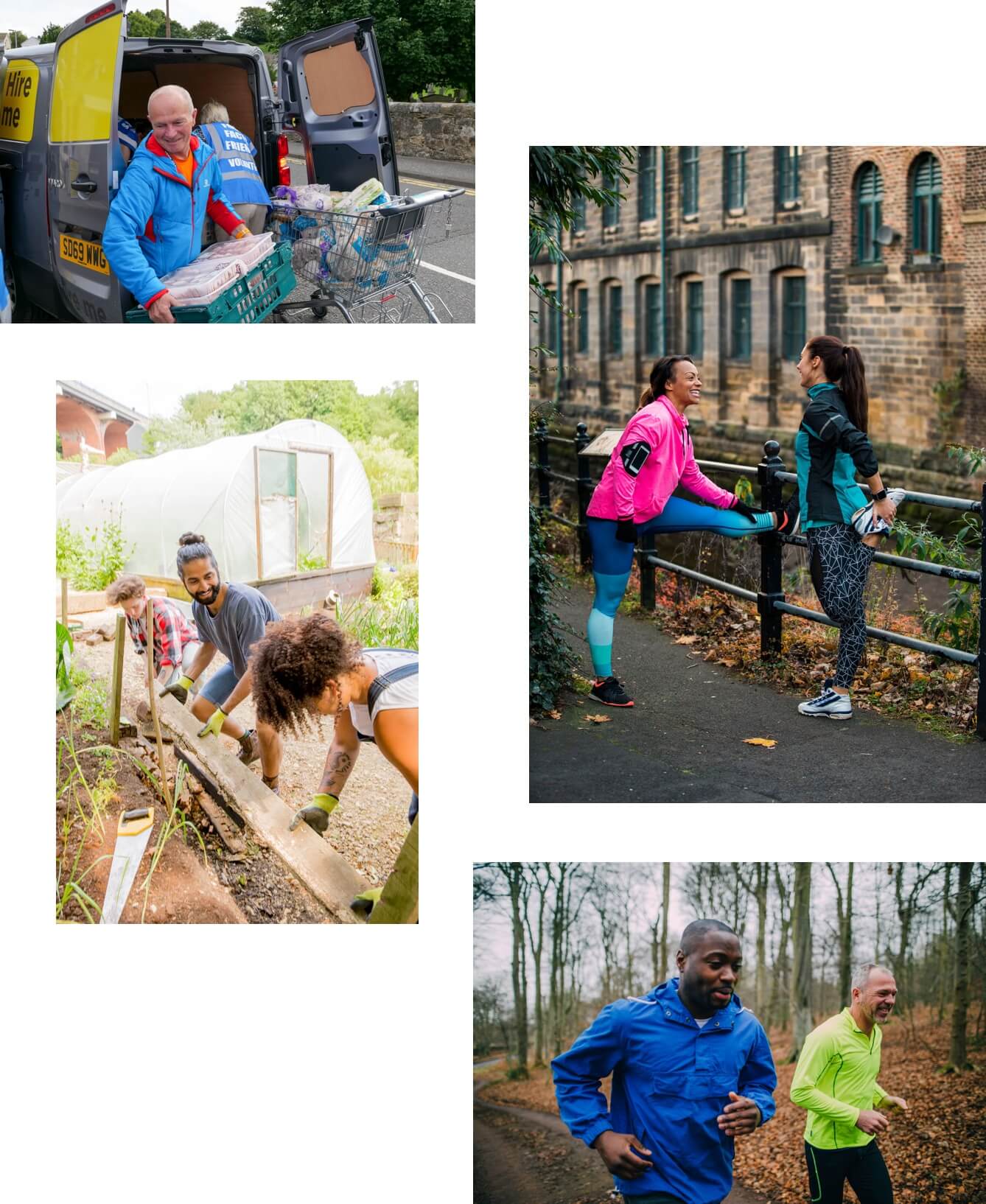

Call us now Learn moreLearn about how we assist people in rebuilding their lives through our advisory and referral service. Addiction treatment should not just be about attending meetings or seeing a 'professional'. Instead, treatment needs to be accompanied by deep and lasting lifestyle changes, including a shift in what you feel you are capable of achieving.

View Our Mission

OK Rehab is a recovery advocate service. OK Rehab was founded by people who are living their lives ‘in recovery’. We aim to offer addiction treatment options for all, no matter what the situation they may be facing right now. All of our helpline advisors have ‘wore the t-shirt when it comes to issues surrounding addiction, including being ‘helpless’, ‘hopeless’, and ‘homeless’. We act as a referral and advisory service in helping signpost your a variety of addiction treatments.

We help facilitate treatment for anyone who actively wants to stop using drugs or drinking alcohol. This desire is often easier said than done. If your loved one is in denial about his or her addiction, then we are also able to assist via an intervention programme. We do not offer specific health advice, nor are we a remote clinical advice service (RCA). We can, with your consent, pass your details to our partners that can offer this.

We help individuals seeking to self-refer themselves into addiction treatment. We also help concerned third parties, such as loved ones, friends, co-workers, and employers who wish to help a person accept the need for addiction treatment.

OK Rehab is a helpline solely made up of people who have experienced addiction themselves. At OK Rehab, we know there is no 'cure' for addiction. Instead, we believe addiction is a chronic and life-long addiction those in recovery must constantly guard against in order to prevent relapse. We can, with your consent, pass your details to our partners that can offer this. We receive a commission if you begin treatment with a fee-paying provider. Learn more here.

Learn More

Witnessing a teen or young adult's descent into addiction is heart-breaking. For this reason, we have identified specialist treatment providers who are able to assist with the process of helping teens and young adult's re-set their lifestyles without using drugs and drinking alcohol.

LEARN MOREGroup therapy is an integral part of modern addiction therapy. Peer learning and insight discovery is often far more powerful compared to the more traditional approach of sitting in one-to-one therapy sessions with a registered addiction therapist or counsellor.

LEARN MORE

This is a list of rehab centres that offer support for substance abuse. Click on your state to find addiction treatment resources near you. We are able to recommend fee-paying and free treatments, depending on your needs.

Giving back to the community who assisted you in gaining your recovery is an effective way to sustain your own recovery and prevent relapse. Learn about volunteering options within the drug and alcohol treatment sector.

Be a Part Of It